Quick overview

The CIBC Aeroplan Visa Infinite Card may just be the perfect companion for travellers who often fly with Air Canada. You can earn up to 1.5 Aeroplan points for every dollar spent on eligible gas, electric vehicle charging, groceries and with Air Canada directly. This includes Air Canada Vacations, as well as 1 Aeroplan point on all other purchases†. Overall, it’s a great way to rack those Aeroplan points quickly – letting you jet set around the globe more often on your credit card’s dime.

However, the card does have its disadvantages. For starters, it lacks lounge access, a popular feature offered with other travel credit cards. It’s also only available to those who make $60,000 per year as an individual or $100,000 as a household.

Who’s this card for?

First and foremost, this card is for travellers who like to see the world while earning points that allow them to do it more often. Specifically, though, it’s for those who prefer flying with Air Canada, since the airline owns the Aeroplan points system.

Pros and cons

Pros

-

Earn up to 40,000 bonus Aeroplan points in the first year

-

Earn up to 1.5 Aeroplan points on purchases

-

Free checked bags on Air Canada flights

-

Special pricing on Aeroplan flight rewards

-

Includes travel insurance

Cons

-

High income requirement of either $60,000 personal or $100,000 household

-

Rewards go furthest when redeeming for Air Canada flights, so that can limit your travel options

How to earn the CIBC Aeroplan Visa Infinite welcome bonus

How to earn Aeroplan points with the Aeroplan Visa Infinite from CIBC

With this card, you earn 1.5 Aeroplan points on eligible gas, electric vehicle charging, groceries and with Air Canada directly, including through Air Canada Vacations®†. It also earns 1 Aeroplan point on all other purchases† and 2x points at over 150 Aeroplan partners and over 170 online retailers through the Aeroplan eStore.

You’ll earn the most points the quickest if you spend in the highest category, which includes gas and groceries – two major spending areas for most people.

How to redeem those points

Redeeming points is a straightforward process through Air Canada’s Aeroplan rewards centre, which can be used to redeem points for any of the CIBC Aeroplan credit cards. It’s a nifty hub that houses all your rewards options in one place. On the website, you can redeem your points for Air Canada and partner airline flights, redeem for extras and upgrades on flights, hotels and car rentals, vacation packages, travel experiences, merchandise and gift cards.

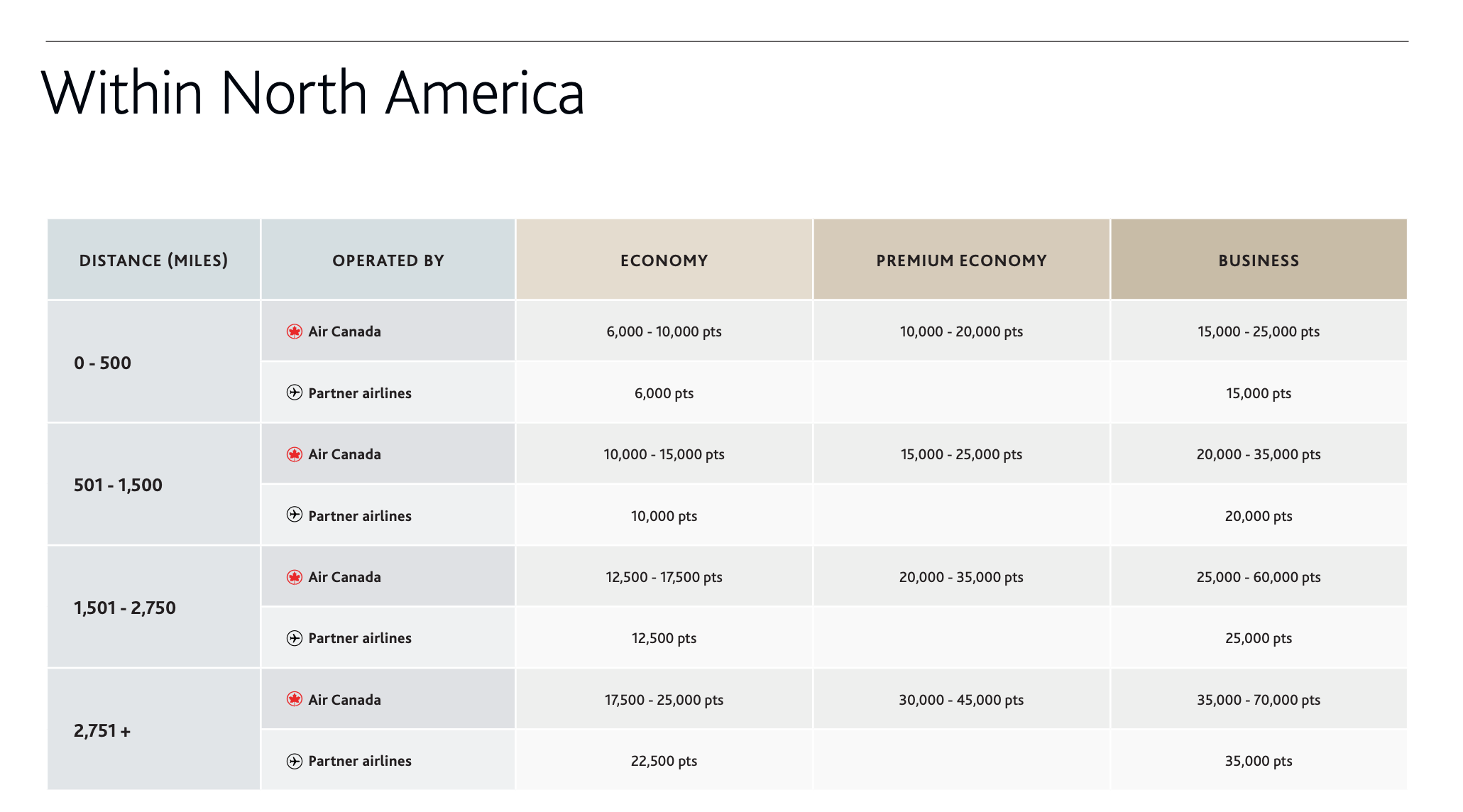

No matter what you’re interested in using your points for, it seems there’s something for everyone. Where you’ll likely get the most bang for your buck, though, is with redeeming for travel through Air Canada and its partner airlines. Below is a breakdown of how many points are required to fly within North America.

CIBC Aeroplan Visa Infinite benefits of note

- Join and get up to $1,100 in value in your first year!†

- Earn 1.5 Aeroplan points on eligible gas, electric vehicle charging, groceries and with Air Canada directly, including through Air Canada Vacations®†

- Earn 1 Aeroplan point on all other purchases†

- Earn points twice at over 150 Aeroplan partners and more than 170 online retailers through the Aeroplan eStore

- Good travel insurance

- Free checked bags on Air Canada flights

CIBC Aeroplan Visa Infinite Insurance coverage

- Flight delay and baggage insurance: This covers reimbursements for expenses to your hotel during a flight delay, up to $500. It reimburses for reasonable living expenses, such as meals and accommodations during a delay, up to a maximum of $500 if the flight was charged to your card.

- Out-of-province emergency travel medical insurance: This covers the primary cardholder, spouse, and dependent children for up to $500,000 per insured person per trip. It also covers access to emergency travel services when travelling outside your province or territory of permanent residence.

- Trip cancellation/trip interruption insurance: This covers up to $2,000 for trip interruption and rip cancellation.

- Auto rental collision/loss damage insurance: This covers the full value of the vehicle for theft, loss, and damage, if the rental is charged to your card. This coverage has a limit of $65,000.

- Purchase security and extended protection insurance: This offers an extended warranty of 1 year on top of the manufacturer’s warranty for items purchased with one of your CIBC Aeroplan cards. This also covers the original cost of purchase in the event of loss, theft, or damage.

- Mobile device insurance: Up to $1,000, which covers your mobile devices in case of loss, accidental damage, or theft. Coverage is triggered 91 days after your purchase. It covers the cost of the phone, minus depreciation.

Extra benefits

- Exclusive Visa Infinite offers, such as hotel benefits, dining events and 24-hour complimentary concierge services

- Book flight rewards for fewer points

- Get a fourth night free when booking a hotel with Aeroplan points

- Get rental car upgrades, expedited service, and a dedicated phone like with a complimentary Avis Preferred Plus upgrade

What people have to say about CIBC Aeroplan Visa Infinite

One lucky reddit user, who applied for a CIBC Aeroplan Visa Infinite card, claims they were given the Aeroplan welcome bonus even though they were rejected for the card. It’s unclear how that happened, but the user claims they’re an existing CIBC customer, which might have something to do with it. Then again, it could just be a glitch. Either way, we can’t advise this as a strategy for trying to earn extra points.

How CIBC Aeroplan Visa Infinite compares

CIBC Aventura® Visa Infinite* Card

4.9

Up to $1,300 value†

Welcome offerGood

Suggested credit scoreJoin and get up to $1,300 in value including a first year annual fee rebate!†

Pros

-

First year annual fee rebate

-

High welcome bonus

-

Easy-to-use points redemption process

-

Nexus application fee rebate

-

Four complimentary lounge passes that can be used at 1,200+ airports

-

Mobile device and extended warranty insurance

Cons

-

Uninspired travel insurance offering

-

Difficult to earn points through daily spending

-

$139 annual fee that’s hard to justify

Eligibility

Good

Recommended Credit Score

$60,000†

Required Annual Personal Income

$100,000†

Required Annual Household Income

Recommended Credit Score

Good

Required Annual Personal Income

$60,000†

Required Annual Household Income

$100,000†

2

points for every $1 spent on travel purchased through the CIBC Rewards Centre†

1.5

points for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1

point for every $1 spent on all other purchases†

points for every $1 spent on travel purchased through the CIBC Rewards Centre†

2

points for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1.5

point for every $1 spent on all other purchases†

1

20.99%†

Purchase APR non-Quebec residents†

22.99%†

Balance Transfer Rate for non-Quebec residents†

22.99%†

Cash Advance APR for non-Quebec residents†

$139

Annual Fee First year annual fee rebate!† $50 up to 3 additional cards†

2.5%

Foreign Transaction Fee 2.5% of the transaction in CDN

Purchase APR

20.99%†

Balance Transfer Rate

22.99%†

Cash Advance APR

22.99%†

Annual Fee

$139

Foreign Transaction Fee

2.5%

Pros

-

First year annual fee rebate

-

High welcome bonus

-

Easy-to-use points redemption process

-

Nexus application fee rebate

-

Four complimentary lounge passes that can be used at 1,200+ airports

-

Mobile device and extended warranty insurance

Cons

-

Uninspired travel insurance offering

-

Difficult to earn points through daily spending

-

$139 annual fee that’s hard to justify

Eligibility

Good

Recommended Credit Score

$60,000†

Required Annual Personal Income

$100,000†

Required Annual Household Income

Recommended Credit Score

Good

Required Annual Personal Income

$60,000†

Required Annual Household Income

$100,000†

2

points for every $1 spent on travel purchased through the CIBC Rewards Centre†

1.5

points for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1

point for every $1 spent on all other purchases†

points for every $1 spent on travel purchased through the CIBC Rewards Centre†

2

points for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1.5

point for every $1 spent on all other purchases†

1

20.99%†

Purchase APR non-Quebec residents†

22.99%†

Balance Transfer Rate for non-Quebec residents†

22.99%†

Cash Advance APR for non-Quebec residents†

$139

Annual Fee First year annual fee rebate!† $50 up to 3 additional cards†

2.5%

Foreign Transaction Fee 2.5% of the transaction in CDN

Purchase APR

20.99%†

Balance Transfer Rate

22.99%†

Cash Advance APR

22.99%†

Annual Fee

$139

Foreign Transaction Fee

2.5%

CIBC Aeroplan Visa Infinite Vs. CIBC Aventura Visa infinite

This might be the closest 1:1 credit card comparison out there. I mean, they even share a name (almost)! They both have the same yearly fee ($139) with the cost of the first year waived. Even their points breakdowns are similar, with both offering 1.5 points for every dollar spent on gas, grocery stores, and electric vehicle charging (though the Aventura card does give points for drugstore purchases). All other spending will net you 1 point for every dollar spent at other retailers, regardless of the card you choose. The welcome bonuses are also fairly similar. As for insurance, both offer a robust package that includes all of the standard travel offerings.

However, where the CIBC Aventura Visa Infinite outshines the Aeroplan card is with its travel perks. It comes with lounge access and 4 free visits per year, as well as a $67† NEXUS◊ Application Fee rebate†.

This offer is not available for residents of Quebec.

†Terms and Conditions Apply

The information for the CIBC Aventura® Visa Infinite* Card has been collected independently by Money.ca. The card details on this page have not been reviewed or provided by the card issuer.

American Express Cobalt® Card

4.9

up to 15k pts

Welcome offerFair

Suggested credit scoreEarn up to 15,000 Welcome Bonus Membership Rewards® points* – that’s up to $150 in value.

Pros

-

High earn rates (up to 5% return on spending!)

-

Flexible month-by-month fee structure

-

Free supplementary cards

-

1:1 points transfer with selected hotels, airlines and frequent flyer programs

Cons

-

Accelerated earn rates only apply to purchases in Canada (not to purchases made abroad)

-

Amex has a more limited merchant acceptance rate than Visa and Mastercard

-

Slightly higher than average annual fee

Eligibility

Fair

Recommended Credit Score

$0

Required Annual Personal Income

$0

Required Annual Household Income

Recommended Credit Score

Fair

Required Annual Personal Income

$0

Required Annual Household Income

$0

5x

the points on eligible eats & drinks purchases in Canada

3x

the points on eligible streaming subscriptions in Canada

2x

the points on eligible gas, transit & ride share in Canada

1x

the points on everything else

1

additional Membership Rewards point for every $1 you charge on eligible hotel or car rental bookings made with American Express Travel

$100 USD

Get up to $100 USD hotel credit to use on amenities like dining, spa or other leisure facilities when charged to the room

the points on eligible eats & drinks purchases in Canada

5x

the points on eligible streaming subscriptions in Canada

3x

the points on eligible gas, transit & ride share in Canada

2x

the points on everything else

1x

additional Membership Rewards point for every $1 you charge on eligible hotel or car rental bookings made with American Express Travel

1

Get up to $100 USD hotel credit to use on amenities like dining, spa or other leisure facilities when charged to the room

$100 USD

21.99%

Purchase APR

21.99%

Cash Advance APR

$155.88

Annual Fee 12.99/month

2.5%

Foreign Transaction Fee 2.5% of the transaction in CDN

Purchase APR

21.99%

Cash Advance APR

21.99%

Annual Fee

$155.88

Foreign Transaction Fee

2.5%

Pros

-

High earn rates (up to 5% return on spending!)

-

Flexible month-by-month fee structure

-

Free supplementary cards

-

1:1 points transfer with selected hotels, airlines and frequent flyer programs

Cons

-

Accelerated earn rates only apply to purchases in Canada (not to purchases made abroad)

-

Amex has a more limited merchant acceptance rate than Visa and Mastercard

-

Slightly higher than average annual fee

Eligibility

Fair

Recommended Credit Score

$0

Required Annual Personal Income

$0

Required Annual Household Income

Recommended Credit Score

Fair

Required Annual Personal Income

$0

Required Annual Household Income

$0

5x

the points on eligible eats & drinks purchases in Canada

3x

the points on eligible streaming subscriptions in Canada

2x

the points on eligible gas, transit & ride share in Canada

1x

the points on everything else

1

additional Membership Rewards point for every $1 you charge on eligible hotel or car rental bookings made with American Express Travel

$100 USD

Get up to $100 USD hotel credit to use on amenities like dining, spa or other leisure facilities when charged to the room

the points on eligible eats & drinks purchases in Canada

5x

the points on eligible streaming subscriptions in Canada

3x

the points on eligible gas, transit & ride share in Canada

2x

the points on everything else

1x

additional Membership Rewards point for every $1 you charge on eligible hotel or car rental bookings made with American Express Travel

1

Get up to $100 USD hotel credit to use on amenities like dining, spa or other leisure facilities when charged to the room

$100 USD

21.99%

Purchase APR

21.99%

Cash Advance APR

$155.88

Annual Fee 12.99/month

2.5%

Foreign Transaction Fee 2.5% of the transaction in CDN

Purchase APR

21.99%

Cash Advance APR

21.99%

Annual Fee

$155.88

Foreign Transaction Fee

2.5%

CIBC Aeroplan Visa Infinite Vs. American Express Cobalt

If you’re looking for a rewards card, it makes sense that you’d compare the CIBC Aeroplan Visa Infinite and American Express Cobalt. The Visa Infinite is tailored to travellers, offering 1.5 Aeroplan points for every dollar spent on gas, grocery stores, and electric vehicle charging and 1 point per dollar spent on everything else.

The Amex Cobalt, meanwhile, will earn you 5x points on eligible dining and groceries in Canada, 3x points on eligible streaming subscriptions in Canada, 2x points on eligible rideshares, transit and gas in Canada and 1x point on all other purchases. 1 additional Membership Rewards point on eligible hotel and car rental bookings via American Express Travel Online

That’s a lot of opportunity to rack up the points, particularly if you’re a foodie – and that’s not even mentioning the welcome bonus. The card does come at a cost, though, with a fee of $12.99/month ($155.88 per year).

Is the CIBC Aeroplan card worth it?

The CIBC Aeroplan Visa Infinite is worth it if you want to earn Aeroplan points. Its generous welcome bonus of 40,000 points (and first year free) make it an enticing card for any traveller. Couple that with its travel insurance and points earning potential and you’ve got yourself one solid credit card.

†Terms and Conditions Apply

- This is a digital-exclusive offer†To be eligible for this offer:

- this offer must have been directly communicated to you from CIBC or from a partner/affiliate; and

- you must apply for the eligible card through the link provided in the CIBC or partner/affiliate communication to you.†

This offer is reserved for you. Please do not forward it to anyone else.CIBC may approve your application, but you are not eligible to receive this Offer if you have opened, transferred or cancelled another eligible card within the last 12 months.††Terms and Conditions ApplyThis offer is not available for the residents of Quebec. For Quebec Residents offer - visit CIBC.com product page here.

The information for the CIBC Aeroplan Visa Infinite Card has been collected independently by Money.ca. The card details on this page have not been reviewed or provided by the card issuer.

FAQs

Justin is a writer and editor who has been covering personal finance for over 10 years. He's written for companies such as KOHO, Ratehub, BMO, Zoocasa, and Questrade, among others. Justin also created a course in Content Creation, which he taught at York University for four years. When not writing, Justin can be found at a live concert, on the golf course, riding a motorcycle, or sailing.

Compare other CIBC credit cards

Compare other CIBC credit cards

Compare other Visa credit cards

Compare other Visa credit cards

Compare other travel credit cards

Compare other travel credit cards

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.