Best trading platforms in Canada

Updated: November 27, 2024

Self-directed online investing has exploded in popularity thanks to the best of these online brokers driving down costs and making it easy for investors to manage their own portfolios.

Gone are the days of $29 trades.

Today, investors using an online trading platform can trade stocks and ETFs for free from their mobile devices or access robust market research tools and charts to help them trade like a pro.

Here are the best trading platforms in Canada with their current promotions

| Trading platform | Promotion | Get started |

|---|---|---|

|

Questrade

|

Start Investing with Questrade and get $50 in Free Trades (when you fund your account with $1,000) | Start investing |

|

Wealthsimple

|

For a limited time, get a $25 cash bonus when you open a Wealthsimple Trade account and fund at least $150 | Start investing |

| Qtrade Direct Investing™ | Sign-up bonus available to new clients only. New clients get unlimited free trades until Dec 31, 2024. $100 Sign-up bonus and free trades rebate will be paid by Jan 31, 2025. Use promo code: SUMMERBONUS2024 | Start investing |

|

BMO InvestorLine Self-Directed

|

N/A | Start investing |

|

CIBC Investor's Edge

|

For a limited time, with CIBC Investor’s Edge, get 100 free trades using promo code EDGE2425 and $200 or more cash back until March 31, 2025. | Start investing |

|

Moomoo Financial Canada

|

Get up to $2,200 in rebates

◦ Enjoy $2,000 commission rebate card ◦ Deposit $100 or more and receive $50 stock cash coupon ◦ Deposit $2,000 or more and receive $200 stock cash coupon ◦ Deposit any amount and receive 6% per annum (up to $10,000 on uninvested cash) |

Start investing |

An online broker lets you buy and sell stocks, ETFs, and mutual funds online within your trading account. They’re often called “online brokerage” or “discount brokerage” because this trading method is more cost-effective than a traditional brokerage.

Using a trading platform (or online broker), you’re the boss: you make the investment decisions and choose what to purchase. While you can purchase individual stocks and bonds through your online broker, most DIY investors opt to build their portfolios out of ETFs. This strategy lets you build a highly diversified portfolio without worrying about buying stocks one at a time.

But with so many online brokerages out there, you may be asking, “What’s the best trading platform in Canada for me?”

To help you get started, we’ve put together a guide comparing the best online brokers in Canada, as well as some tips on how to choose the best trading platform in Canada for you.

Best trading platform in Canada, overall: Questrade

- Account maintenance fees: $0 per year

- Trading commission: $4.95 – $9.95 + Free ETF purchases

Already got an investment account with another institution? Moving your investments to Questrade is easy. Just fill out an online form and Questrade will handle the transfer. Plus, it covers any transfer fees up to $150 per account.

On the downside, the account minimum is $1,000. So if you’ve got less than that to invest, you might want to go with a commission-free trading platform (like Wealthsimple Trade account) instead. Investors should also watch out for ECN fees, which are charged on buy/sell orders that are filled immediately (avoid these by placing limit orders).

Questrade pros and cons

Pros

-

Low trading fees for Canadian and US stocks

-

No annual fees or inactivity fees

-

Free ETF purchases

-

Pays transfer fees up to $150

-

Instantly deposit up to $3,500 into your Questrade account and start trading immediately.

Cons

-

Need a minimum of $1,000 in your account to start investing

-

ECN fees charged on buy/sell market orders

Best online broker for commission-free trading: Wealthsimple self-directed investing

- Account maintenance fees: $0 per year

- Trading commission: $0

If you’re looking for the best commission-free trading platform in Canada, Wealthsimple Trade account allows you to buy and sell stocks, ETFs, and even crypto without paying any fees. There are also no account minimums, annual fees, or inactivity fees. So you can test-drive the platform without getting hit with trading fees for each transaction.

Wealthsimple Trade pros and cons

Pros

-

Commission-free trading

-

Buy fractional shares

-

$0 annual fees

-

Offers crypto trading

-

Reimburses transfer fees for investment transfers that are greater than $5,000 in value

Cons

-

Limited account types (RRSP, TFSA, non-registered)

-

Can’t hold USD so clients pay FX fees when buying and selling US-listed stocks and ETFs with a free account.

Best online broker in Canada for customer service: Qtrade

- Trading commission: $8.75 per trade or $7.75 for young investors

- Account maintenance fees: Qtrade’s quarterly $25 fee is on the high side, but it can be waived if you meet conditions.

- If you’re interested in trading ETFs, Qtrade offers over 100 commission-free options. These ETFs cost you nothing to buy or sell with no minimums required, making this a good option for easy and diversified investing at any level.

Qtrade is a good alternative to Questrade and has a reputation for amazing customer service, ranking in the top 1 or 2 in Surviscor’s annual brokerage reviews. The company is trustworthy, too. Operating since 2001,a division of Credential Qtrade Securities Inc., Qtrade is owned by Aviso Wealth, one of Canada's largest independent wealth management firms, which is entrusted with over $120 billion of investment assets on behalf of 500,000 clients from coast to coast. And is a member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada.

If you’re interested in trading ETFs, Qtrade offers over 100 commission-free options. These ETFs cost you nothing to buy or sell with no minimums required, making this a good option for easy and diversified investing at any level.

Maintaining an account with Qtrade is slightly more expensive than Questrade, but still very cost-effective, setting you back $100 per year for portfolios with less than $25,000 in combined assets. This fee is waived if any of the following apply: it is less than one quarter since account opening, you have $25,000 or more in assets, completed 2 commissioned trades in the last quarter, completed 8 commissioned trades in the last 12 months, set up a $100/mo recurring deposit, qualify for the Young Investor offer.

Most investors will pay $8.75 per trade with Qtrade, and there are no account minimums. If you incur fees when transferring your assets to Qtrade, they will cover $150 or more in tax when transferring $15,000 or more.

To better understand what you get with Qtrade, read and compare Qtrade vs. Questrade in our review.

Qtrade pros and cons

Pros

-

Second-to-none portfolio analytics tools and multiple portfolio views

-

In-depth research and analysts’ reports

-

Stock/ETF/mutual fund screening tools

-

$8.75 and $6.95 stock trades and 100 free ETFs (free to buy and sell, no minimums)

-

Use stop-loss, stop-limit, trailing-stop orders

Cons

-

Fees for portfolios smaller than $25,000 may apply.

Qtrade promo

Sign-up bonus available to new clients only. New clients get unlimited free trades until Dec 31, 2024. $100 Sign-up bonus and free trades rebate will be paid by Jan 31, 2025. Use promo code: SUMMERBONUS2024

Receive up to $150 per Transfer Request when the client transfers-in $15,000 or more (can be combined with Cashback + Free Trades Offer)

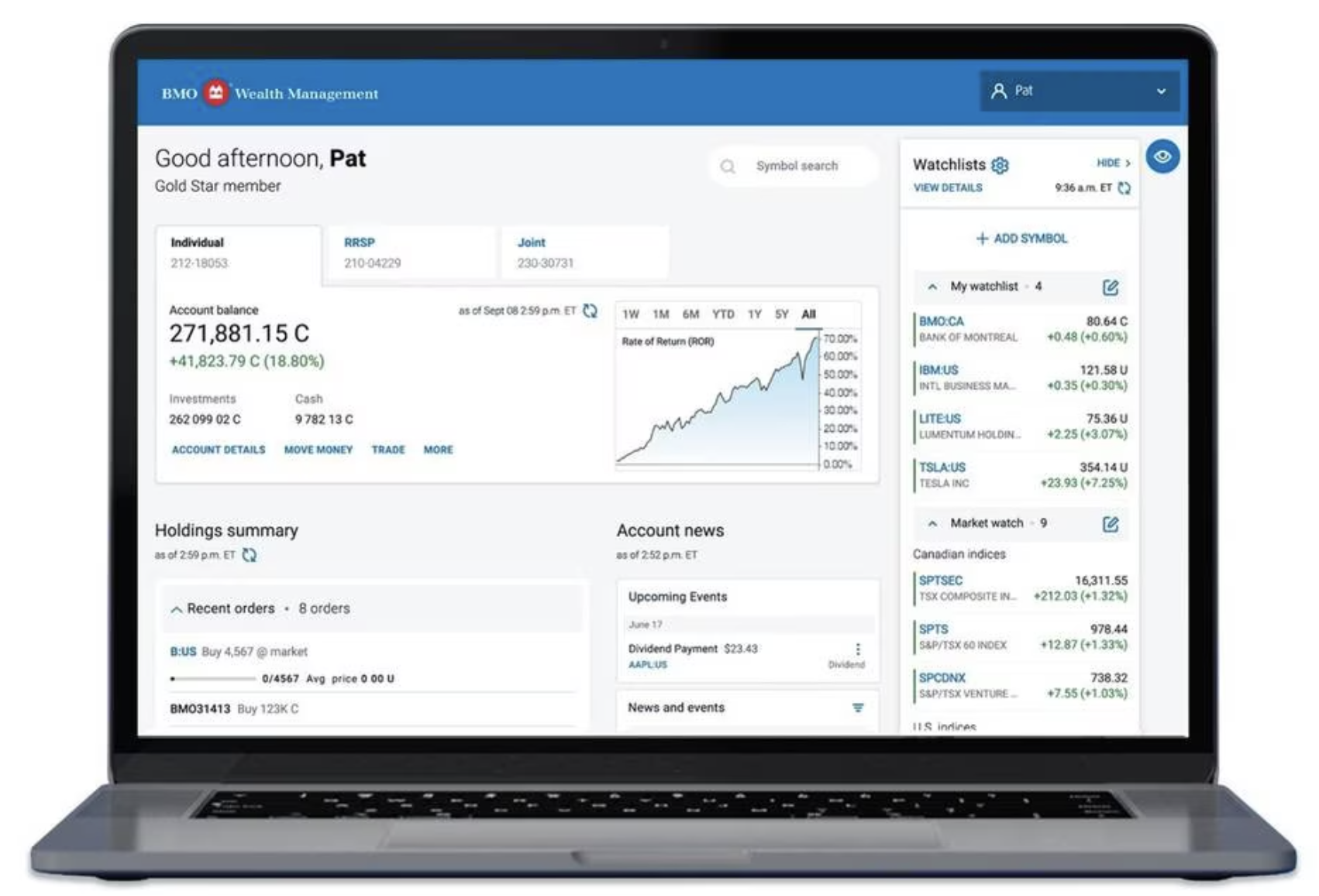

Best trading platform with a big bank: BMO InvestorLine Self-Directed

- Account maintenance fees: $0 - $100 per year

- Trading commission: $9.95

BMO InvestorLine Self-Directed is an excellent choice for anyone looking to get started with an online discount brokerage at a big bank who doesn’t want to pay commissions on ETF trades.

BMO InvestorLine Self-Directed is an excellent choice for anyone looking to get started with an online discount brokerage at a big bank who doesn’t want to pay commissions on ETF trades.

In 2021, BMO InvestorLine Self-Directed launched an impressive list of 80 commission-free ETFs for clients to trade (including Vanguard, iShares, and BMO ETFs).

BMO InvestorLine Self-Directed’s user-friendly portal, along with its impressive library of third-party research and solid customer service, will help you invest with confidence, whether you are a seasoned investor or a complete beginner.

BMO InvestorLine Self-Directed isn’t the least expensive discount brokerage, with fees on accounts under $25,000. Still, their zero minimum balance requirement, 80 commission-free ETFs, and award-winning platform are enough to overcome any drawbacks.

BMO InvestorLine pros and cons

Pros

-

80+ commission-free ETFs to trade

-

Excellent online and mobile app

-

Hold USD and CAD in non-registered and registered accounts

-

Great third-party research

-

$0 minimum account balance for RRSPs and TFSAs

Cons

-

$9.95 per trade on stocks and ETFs that aren’t included in the 80 commission-free list

-

$100 for account balances less than $25,000

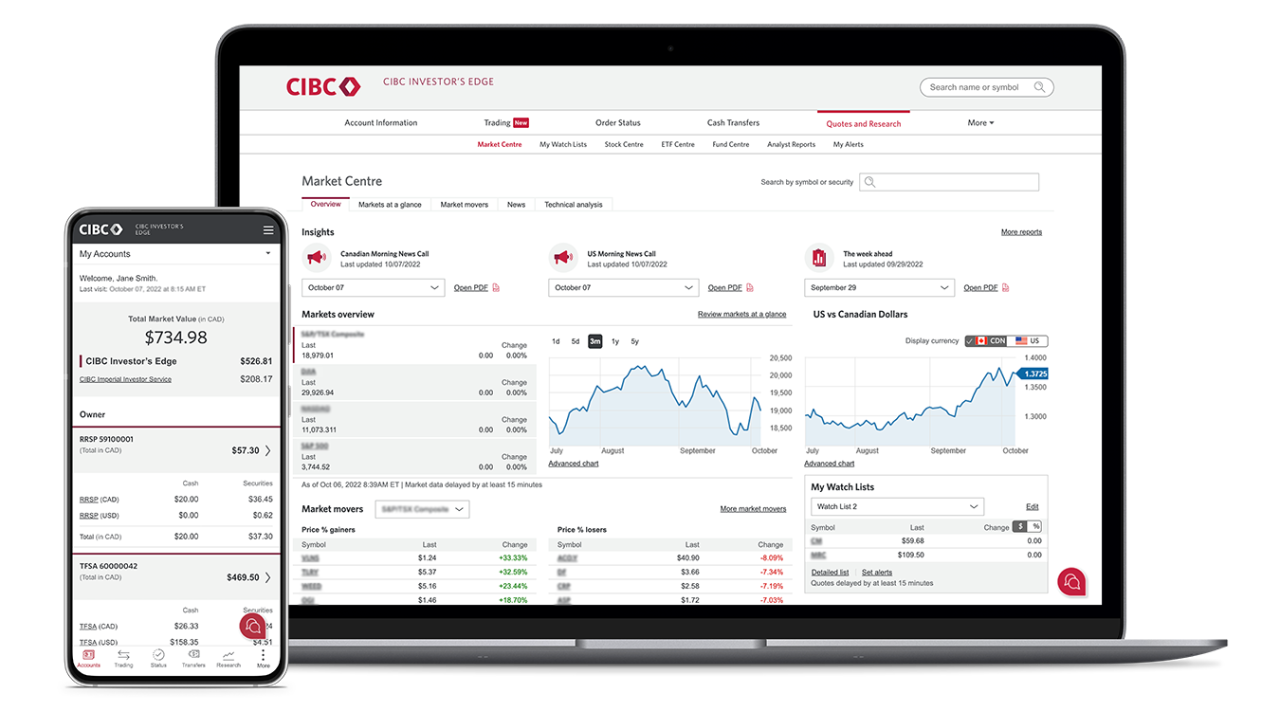

Best trading platform for stocks: CIBC Investor’s Edge:

- Account maintenance fees: $0-$100 per year

- Trading commission: $6.95 per online equity trades only

- Promo offer: For a limited time, with CIBC Investor’s Edge, get 100 free trades when you open a CIBC Investor’s Edge account using promo code EDGE2425. Plus, get $200 or more cash back. Offer valid until March 31, 2025.

CIBC Investor’s Edge is the discount brokerage arm of CIBC Investor Services Inc. and a subsidiary of CIBC bank. Its newly redesigned website has given the platform a nice user experience.

CIBC Investor’s Edge offers flat fee commissions of $6.95 for stock and ETF trades. That’s the cheapest of all the big bank brokerages, although CIBC doesn’t offer any commission-free ETF trading.

Clients won’t pay account fees when they hold more than $25,000 in their RRSP and more than $10,000 in a non-registered account (TFSAs and RESPs are free).

CIBC Investor’s Edge pros and cons

Pros

-

Flat fee stock and ETF trading at $6.95 (lowest among all big bank brokers)

-

Newly designed website

-

Advanced quotes and research

Cons

-

No commission-free ETFs

Best new trading platform in Canada

- Account maintenance fees: $0

- Trading commission: CAD $0.0149/share (minimum CAD $1.49/trade for Canadian stocks) | USD $0.0099/share (minimum USD $1.99/trade for US stocks)

- Promo offer: Get up to $2,200 in rebates

- Enjoy $2,000 commission rebate card

- Deposit $100 or more and receive $50 stock cash coupon

- Deposit $2,000 or more and receive $200 stock cash coupon

- Deposit any amount and receive 6% per annum (up to $10,000 on uninvested cash)

Moomoo Financial Canada Inc. has quickly become a notable option for newcomers to Canada who are interested in investing. The platform stands out with its low trading fees and robust tools, making it appealing to both beginner and seasoned investors. Moomoo’s combination of a user-friendly mobile app and an advanced desktop trading platform provides comprehensive access to Canadian and US stocks, ETFs, and options. What’s more, newcomers can benefit from Moomoo’s extensive educational resources, including courses on investing fundamentals and strategies, which make the learning curve easier to navigate. For those looking to build confidence, the platform’s paper trading account with $1 million in virtual funds is a great way to practice trading without financial risk.

Moomoo is particularly suited for investors who value detailed market data and analysis tools. The free Level 2 market data feature allows users to dive deeper into stock movements, and the platform’s suite of over 100 technical indicators and 45 charting tools helps in crafting personalized trading strategies. While Moomoo is great for those prioritizing cost-effective trades and advanced analytics, potential investors should note that it supports only four account types—cash, margin, RRSP, and TFSA—and focuses exclusively on US and Canadian markets.

moomoo Canada pros and cons

Pros

-

Low trading commission fees

-

No account maintenance or inactivity fees

-

Free Level 2 market data

-

Comprehensive educational resources

-

Paper trading account with virtual funds

-

Extended trading hours for US securities

Cons

-

Limited to four account types (cash, margin, RRSP, TFSA)

-

No web-based trading platform

-

Commissions can add up for large volume trades

-

Focused only on US and Canadian markets

Comparing the best trading platforms in Canada

| Categories | Questrade | Wealthsimple | BMO InvestorLine Self-Directed | CIBC Investor's Edge | Qtrade | Moomoo Financial |

|---|---|---|---|---|---|---|

| Account Minimum | $1,000 | $0 | $0 | $0 | $0 | $0 |

| Commissions per equity trade | $4.95 - $9.95 | $0 | $9.95 | $6.95 per online equity trades only | $8.75 | $1.49 CAD minimum per trade $1.99 USD for US stocks and ETFs |

| Free ETF Transactions | Yes (purchase only) | Yes | 80 commission-free ETFs | No | 100 commission-free ETFs | No |

| Mobile/Desktop Trading | Both | Both | Both | Both | Both | Both |

| Paid Transfer Fees | Up to $150 per account | Yes, for investment transfers greater than $5,000. | No | No | Up to $150 | Up to $200 |

| Get started | Go to Questrade | Go to Wealthsimple | Go to BMO | Go to CIBC | Go to Qtrade | Go to Moomoo |

A traditional broker, sometimes called a full-service broker, is a person that invests in the stock market on your behalf. You give them direction and insight into your risk tolerance and financial goals, and they recommend investments and execute trades for you.

An online broker is best for those with portfolios of less than $250,000 and who want to manage their investments themselves.

How do online brokerages work?

Online discount brokerages work by facilitating the buying and selling of stocks, bonds, mutual funds, ETFs, and other forms of investment through various stock exchanges. Investors can sign up to use a brokerage’s trading platform, and the brokerage charges the investors fees based on trading volume, activity/inactivity levels, and currency exchange. Investors autonomously choose when to buy or sell their investments.

What are the downsides of investing with an online brokerage?

While online brokers have many advantages (convenience, little to no commission fees, and easy access to trends and company information to name a few), there is one major downside to online trading — you may find yourself easily addicted. The ability to make a trade with just the click of a button may become distracting, preventing you from fulfilling other important activities. Keep this in mind before you begin using an online brokerage and set rules for yourself!

How to choose the best trading platform in Canada

It’s easy to be seduced into signing with the online broker that offers the lowest trade fees, but you should consider more factors than that when comparing the best trading platforms in Canada.

How to open an online brokerage account

- 1.

Start by checking if the broker you’re interested in has a minimum investment requirement, and compare that with how much you can afford to invest.

- 2.

If you meet your new broker’s minimum investment requirement you can fund the account by transferring money from a bank account or another broker into your new online broker. This process should take anywhere from a few days to a week or so.

- 3.

Document any fees charged to you for moving money out of your bank account or previous broker into your new broker, as your new broker might have a policy in which it will reimburse you up to a certain fee amount.

- 4.

Go through any tutorials offered by the broker that might explain how to use its online platform and review any investor education materials it offers as well.

- 5.

Start buying stocks, ETFs, bonds, and mutual funds to your heart’s content!

Which online brokerage is best for beginners?

Questrade, Wealthsimple, BMO InvestorLine Self-Directed, Qtrade, and TD Direct Investing are all great options for beginner stock traders. Due to the fact that Wealthsimple offers no basic trading fees and no annual account fee, this is an ideal choice for younger investors and those who simply wish to try their hands at trading.

Divest from high commissions

Test out an online broker that has no account closure fee or even commission-free trades and then fund the account with the minimum amount required.

That way the stakes are relatively low, and the errors you make while learning the ropes of self-directed trading will have a minimal effect on your financial future. But one thing is certain no matter which online broker you open an account with: Responsible self-directed investing can dramatically increase your overall level of investing knowledge and seriously cut down the fees you would otherwise pay to a robo-advisor or full-service broker, thus increasing your overall return on investment.

Best trading platform in Canada: FAQs

The bottom line on online brokers in Canada

When it comes to getting the most out of your portfolio, the best option is to invest your money yourself, cutting out the middle person and vastly reducing the fees you’ll pay over the lifetime of your investments. While using an online broker to invest your money may seem intimidating at first, a simple portfolio built out of ETFs will give you the growth needed to reach a comfortable retirement, while keeping you in the driver’s seat of your money.

All of the online brokers listed above are good choices, but each has strengths and areas for improvement. However, if you’re looking to take the hassle out of DIY investing plus save big on fees, Questrade is your best bet and our top choice for the best online brokerage in Canada. Ultimately, the right one for you depends on your financial situation, but it’s not a question of if you should switch to an online broker to manage your money – it’s when.

Online brokerage services are offered through Qtrade Direct Investing, a division of Credential Qtrade Securities Inc. Qtrade, Qtrade Direct Investing, and Write Your Own Future are trade names and/or trademarks of Aviso Wealth.

Jordann Brown is a freelance personal finance writer whose areas of expertise include debt management, homeownership and budgeting. She is based in Halifax and has written for publications including The Globe and Mail, Toronto Star, and CBC.

Robb Engen is a leading expert in the personal finance realm of Canada and is also the co-founder of Boomer & Echo, an award-winning personal finance blog.

Investing guides

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

-1691451033.png)