What are Canada Savings Bonds?

CSBs were basically a way for Canadians to lend money to the government. You gave the feds some cash, and years down the line you’d get your money back with interest.

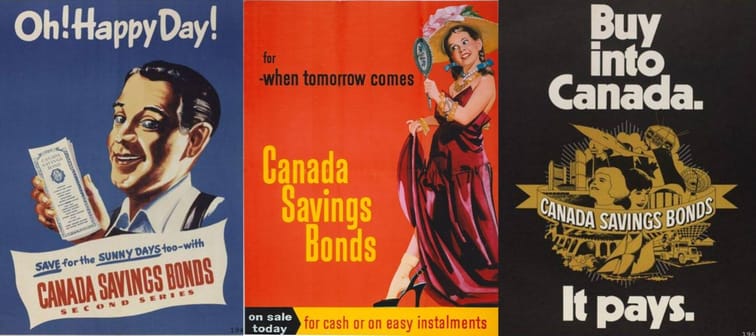

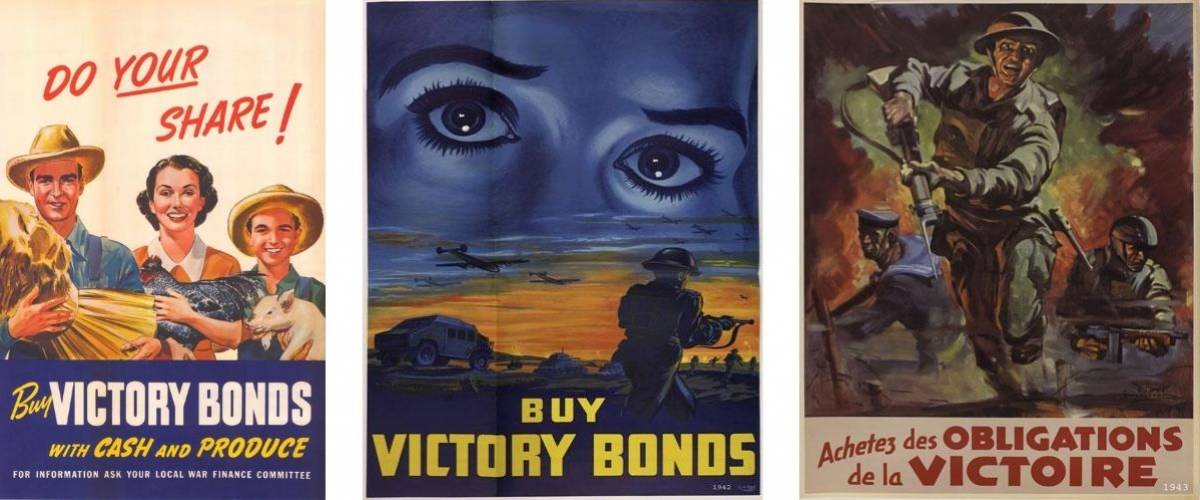

The origin of the CSB dates all the way back to the First World War. In 1915, the Canadian government introduced war bonds — soon dubbed Victory Bonds — to help raise cash for the Allies. They returned in the ’40s to help finance the Second World War.

Then the Canada Savings Bond came on to the scene in 1945. Its mission was to boost the postwar economy and bankroll the government like Victory Bonds did, and the program just kept on rolling.

Since they’re backed by the Government of Canada, CSBs were considered an extremely safe investment. And for a time, they were quite lucrative.

A better online investing experience

Easy to use and powerful, Qtrade's online trading platform puts you in full control with tools and resources that help you make well-informed decisions.

Invest NowWhat does a Canada Savings Bonds look like?

When they were available, you could buy CSBs for as little as $100 or as much as $10,000. Their interest rate was fixed for one year, then started fluctuating with market conditions.

The buyer could choose to either:

- receive regular interest in the form of periodic payments, or;

- receive compound interest — that’s interest building on interest — but only get paid in a lump sum at redemption.

You could cash in CSBs at any time, but they would continue to generate interest for up to 10 years, at which point the bond “matured.” If your CSB wasn’t held in a registered account, that interest is taxable.

If your bond came with a physical certificate, the purchase price, interest type and maturity date are printed on the front.

During the early years of the program, you could get a tidy 2% to 4% back on your investment. Rates peaked during the ’70s and ’80s, reaching a high of 19.5% in 1981. But in recent years, returns spiralled and dipped as low as 0.5%.

The government also offered Canada Premium Bonds, which had a higher interest rate than CSBs but could only be redeemed at a specific time each year.

Why did the government stop Canada Savings Bonds?

A 2004 report from accounting giant KPMG was the beginning of the end.

As the interest rates of CSBs tumbled, Guaranteed Investment Certificates (GICs) started outshining the savings bond because they offered better returns with the same low risk. And toward the end, high-interest savings accounts and even some chequing accounts paid more interest.

Investment plunged from $17 billion in 1987 to just $1.5 billion in 2015. Interest waned to the point that the project cost more to run than it returned.

Accounting giant KPMG sounded the alarm in 2004, saying an end to the program could save the feds $650 million over nine years. After a long period of debate, the CSB was put to rest in November 2017.

Unexpected vet bills don’t have to break the bank

Life with pets is unpredictable, but there are ways to prepare for the unexpected.

Fetch Insurance offers coverage for treatment of accidents, illnesses, prescriptions drugs, emergency care and more.

Plus, their optional wellness plan covers things like routine vet trips, grooming and training costs, if you want to give your pet the all-star treatment while you protect your bank account.

Get A QuoteHow do I redeem my Canada Savings Bond?

Though the Canadian government isn’t issuing any new bonds, it continues to honour the existing ones out there.

If you have a Canada Savings Bond certificate, check the maturity date on the front to see whether it’s past due. Bonds that have matured aren’t making you any more money, so bring it to your bank or financial institution to cash it out.

To see how much you’ll receive, you can check out the government’s redemption value tables online. You’ll just have to punch in the series number on your certificate.

You need the physical piece of paper to redeem the bond, so anyone who’s lost or damaged theirs needs to go through the government’s lost bonds process.

If you didn’t get a physical certificate because you got your CSB through an investment dealer or a special program — like the Payroll Savings Program, Canada RSP Plan or Canada RIF — you’ll either get your money automatically upon maturity by cheque or direct deposit or will need to go through a separate process to withdraw or transfer funds.

You’ll want to look into it soon, as the last of those bonds will stop earning interest by the end of 2021.

What should I do now that the program is over?

With the end of the Canada Savings Bond, investors need to find new options to grow their wealth.

If you became interested in CSBs because of their safe and steady nature, you might consider parking your cash in a GIC or high-interest savings account. These days, some savings accounts offer interest rates as high as 2.5%.

But investors who are feeling frisky and want higher returns might consider a small leap to exchange-traded funds (ETFs).

Like mutual funds, ETFs are bundles of individual stocks and bonds. They don’t cost very much, making it easy to get started, and because ETFs are inherently diversified, they spread your risk around.

To make things even easier, you can ask a robo-advisor to design and manage an ETF portfolio for you. With a company like WealthSimple, all you need to do is choose the level of risk that works for you, and sophisticated software will do the rest.

Then you can monitor what’s happening with your new portfolio — or, like a Canada Savings Bond, leave it to do its magic in the background.

How — and Why — to Increase Your Credit Limit

Maybe it's time to literally give yourself more credit.

See HowTrade Smarter, Today

Build your own investment portfolio with the CIBC Investor's Edge online and mobile trading platform and enjoy low commissions. Get 100 free trades and $200 or more cash back until March 31, 2025.