Home Depot

Home Depot (NYSE:HD) isn’t nearly as exciting as crypto, but it’s the top holding at OUSA, accounting for 5.3 per cent of the fund’s weight.

The home improvement retail giant has around 2,300 stores, with each one averaging approximately 105,000 square feet of indoor retail space — a size that dwarfs most of its competitors.

One thing that makes Home Depot stand out is how well it performed during the pandemic.

Many brick-and-mortar retailers have struggled since the beginning of COVID-19. Yet Home Depot grew its sales nearly 20 per cent in fiscal 2020 to $132.1 billion.

It even boosted its quarterly dividend by 10% earlier this year and now yields 1.9 per cent.

Shares aren’t cheap, though.

After rallying more than 30 per cent year to date, Home Depot trades at over $350 per share. But you can get a piece of the company using a popular stock trading app that allows you to buy fractions of shares with as much money as you are willing to spend.

A better online investing experience

Easy to use and powerful, Qtrade's online trading platform puts you in full control with tools and resources that help you make well-informed decisions.

Invest NowMicrosoft

Tech stocks aren’t known for their dividends, but software gorilla **Microsoft **(Nasdaq:MSFT) is an exception.

The company announced an 11% increase to its quarterly dividend to 62 cents per share last month. Over the past five years, its payout has grown by 59 per cent.

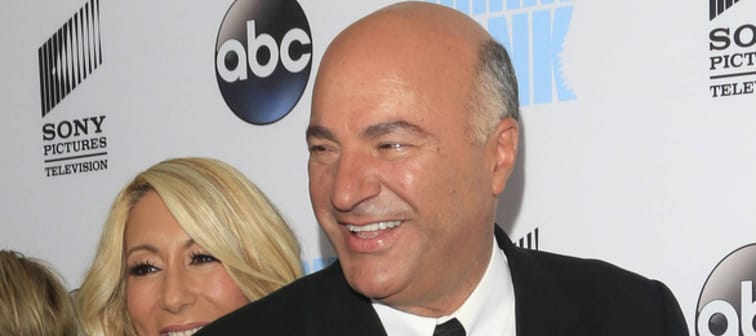

So it shouldn’t come as a surprise that Microsoft is the second largest holding in O’Leary’s OUSA.

Business has been booming of late, largely helped by the pandemic-fueled demand for its cloud-computing and video gaming

In the fiscal year ended June 30, 2021, Microsoft's revenue grew 18 per cent to $168.1 billion while adjusted EPS surged 38 per cent to $7.97.

Year to date, Microsoft shares have returned a whopping 40 per cent, easily topping other trillion-dollar tech giants like Apple (11.8 percent) and Amazon (7 per cent).

Of course, if you’re on the fence about jumping into tech stocks near all-time highs, some investing apps, like Wealthsimple, will give you a $50 cash bonus for your first $150 invested.

Johnson & Johnson

Healthcare is known as a recession-proof industry.

With deeply entrenched positions in consumer health, pharmaceuticals, and medical devices, Johnson & Johnson (NYSE:JNJ) has been able to deliver remarkably consistent returns to investors through thick and thin.

Not only does Johnson & Johnson post recurring profits year in and year out, but it grows them consistently, as well: Over the last 20 years, Johnson & Johnson’s adjusted earnings have increased at an average annual rate of 8 per cent.

Things are even better on the dividend front — the healthcare giant has raised its payout to shareholders for 59 consecutive years.

Not many companies have that kind of track record.

Year to date, shares are up just 3 per cent. But for long-term investors, Johnson & Johnson is a name that should not be ignored.

The company is the third-largest holding in OUSA with a weighting of 4.9 per cent.

Unexpected vet bills don’t have to break the bank

Life with pets is unpredictable, but there are ways to prepare for the unexpected.

Fetch Insurance offers coverage for treatment of accidents, illnesses, prescriptions drugs, emergency care and more.

Plus, their optional wellness plan covers things like routine vet trips, grooming and training costs, if you want to give your pet the all-star treatment while you protect your bank account.

Get A QuoteO’Leary’s other ‘fine’ asset

Gold, crypto, and common stocks aren’t the only things you’ll find in Mr. Wonderful’s portfolio.

He also utilizes a "private" way to diversify and to profit.

If you want to invest in something that has very little correlation with the violent swings of the stock and crypto market, consider this overlooked asset — fine art.

Investing in fine art by the likes of Banksy and Andy Warhol used to be an option only for the ultra-rich like O’Leary.

But with a new investing platform, you can invest in iconic artworks too, just like Jeff Bezos and Peggy Guggenheim.

According to the Citi Global Art Market chart, contemporary artwork has offered a return of 14 per cent per year over the past 25 years, easily topping the 9.5 per cent annual return from the S&P 500.

Trade Smarter, Today

Build your own investment portfolio with the CIBC Investor's Edge online and mobile trading platform and enjoy low commissions. Get 100 free trades and $200 or more cash back until March 31, 2025.